End of the road for Lim Kok Thay’s Hong Kong cruise empire

Tycoon’s cruise ship company Genting Hong Kong will be delisted from the Hong Kong Stock Exchange today.

PETALING JAYA: The Hong Kong Stock Exchange (HKEX) will hammer the final nail into the coffin of casino magnate Lim Kok Thay’s cruise ship company when it delists Genting Hong Kong Ltd today.

A bourse filing last week stated the listing of the company’s shares will be cancelled by HKEX as of 9am today.

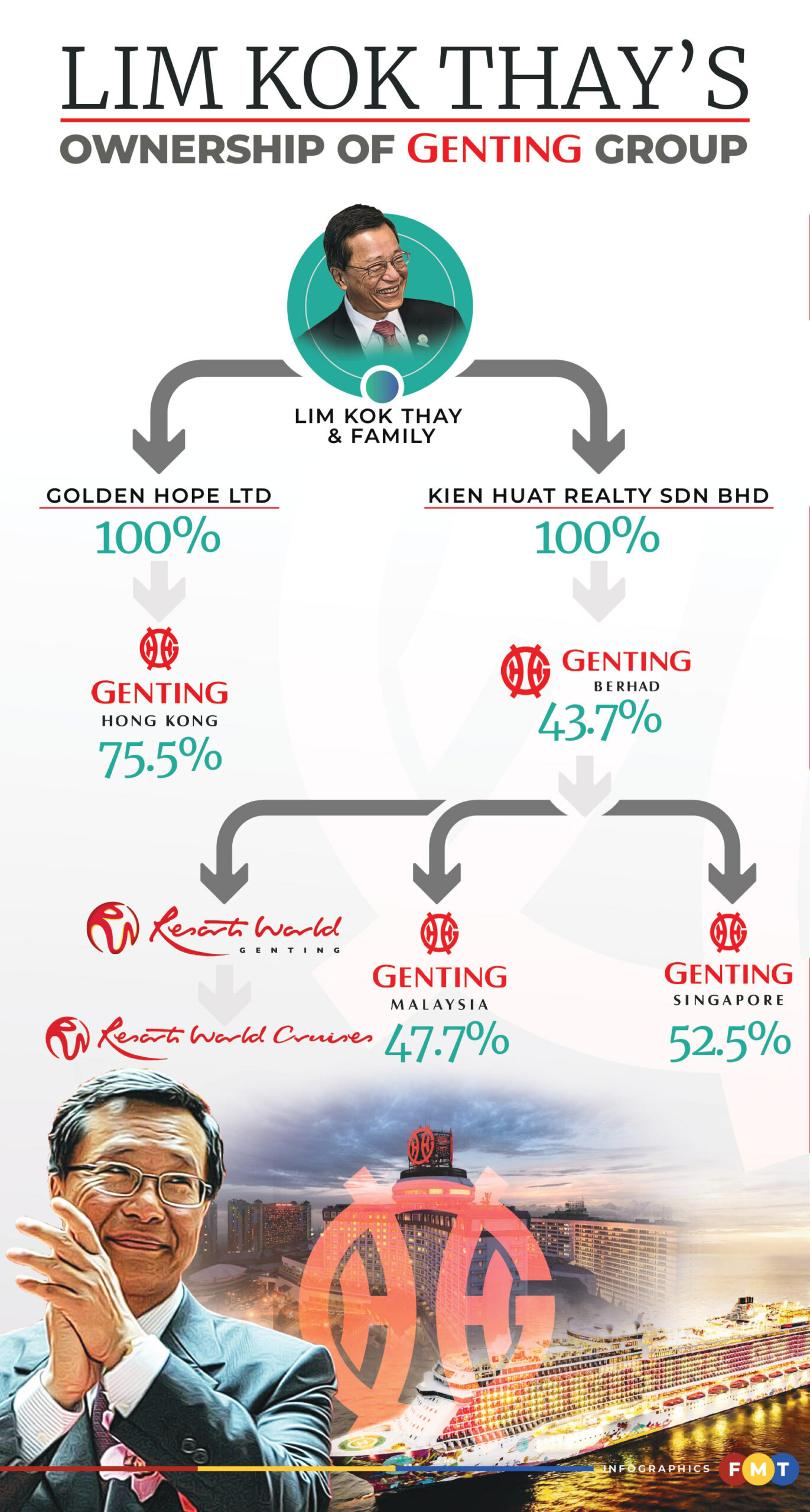

The shares of Genting Hong Kong, in which Kok Thay has a 75.5% stake, have been suspended since Jan 18, 2022. HKEX rules state the shares can be delisted after 18 months, or by July 17, 2023, if trading is not resumed in that time.

The delisting comes after the company filed a petition in the Bermuda court in January last year to be wound up, having defaulted on US$2.8 billion (RM12.6 billion) in debt and failing to secure funding to meet its financial obligations.

Media reports indicated that liquidators appointed by the Bermuda court spent the past year selling off key assets, including cruise ships previously operated under its Asia-facing Dream Cruises and US-facing Crystal Cruises brands, and its German shipbuilding yards.

The HKEX filing said the liquidators confirmed the company had ceased business operations and was not expected to develop any plan to address its insolvency. It added the liquidators requested the HKEX to exercise its discretion to delist the company immediately.

Separately, Genting Hong Kong confirmed that it will not apply for a review of the delisting decision.

The group’s share price was at HK$0.415 (24 sen), valuing the company at HK$3.52 billion (RM2.02 billion).

How Lim’s cruise empire imploded

The 70-year-old Kok Thay – Malaysia’s 7th richest billionaire – is chairman and CEO of Genting Bhd, and deputy chairman and CEO at Genting Malaysia Bhd (GenM).

He built up Genting Hong Kong in the 1990s as a way of diversifying his father’s (Goh Tong) casino business in Malaysia.

Founded under the Star Cruises brand, Kok Thay built up the business by buying ferries from a bankrupt cruise firm. At the start, its first ships were all second-hand, it was only during the Asian Financial Crisis in the late 1990s that it started purchasing new ones.

Over the years, Genting Hong Kong grew into one of Asia’s biggest cruise operators. It extended its business beyond Star Cruises, partly by acquiring other cruise lines. It bought the Crystal Cruises brand in the US and set up the high-end Dream Cruises in Asia.

The company also snapped up several shipyards in Germany in 2015 to build its own vessels. This came at a time when the cruise world was booming, and storm clouds were still in the distant horizon.

However, the two-year Covid-19 pandemic saw the company take on massive losses, and eventually toppling Lim’s once mighty cruise empire. It reported a loss of US$1.7 billion (RM7.65 billion) in May 2021.

By January 2022, cash had run out and the group said it had no access to further funding, and was forced to file a winding up petition in Bermuda in January last year

The firm “exhausted all reasonable efforts” to negotiate with its creditors and stakeholders, it said in a statement to HKEX at the time.

Like a phoenix rising from the ashes

Even though Kok Thay has been dealt a heavy blow in the cruise business, it has certainly not derailed his cruise ambitions. Far from it.

In fact, the wily Kok Thay has already made a comeback with another cruise business iteration – Resorts World Cruises – launched in March last year, just a couple of months after Genting Hong Kong filed to wind up.

The company began sailing from Marina Bay in Singapore in June last year.

Perhaps the biggest irony of all is that Resorts World Cruises is leasing most of its vessels from the consortium of banks that now own the assets of Genting Hong Kong.

One such vessel is Genting Dream, a ship once operated by the Genting Hong Kong-owned Dream Cruises.

“We started our cruise operations 30 years ago in Singapore and we are excited to again launch the first Resorts World Cruises in Singapore, the first country to reopen cruising in the region.

“Resorts World Cruises will have its headquarters in Singapore and is committed to making Singapore the leading cruise hub in Asia,” Kok Thay said in a previous interview.

Resorts World Cruises is owned by Two Trees Family, which is a brand of Resorts World, in which Kok Thay and his family have an indirect stake.

Michael Goh, the president and head of international sales of Resorts World Cruises, is the former president of Dream Cruises and former head of sales for Genting Cruise Lines.

Genting and GenM, which are listed on the local bourse, are not expected to be affected by the huge losses at Genting Hong Kong.

Genting and GenM were reported to have sold off their combined 17% stake in the cruise operator in 2016.

Even before the last rites were administered on Genting Hong Kong, Kok Thay had already incubated what he hopes will be a new cruise empire. Only time will tell if it will have a happier ending.

Desain Rumah Kabin

Rumah Kabin Kontena

Harga Rumah Kabin

Kos Rumah Kontena

Rumah Kabin 2 Tingkat

Rumah Kabin Panas

Rumah Kabin Murah

Sewa Rumah Kabin

Heavy Duty Cabin

Light Duty Cabin

Source