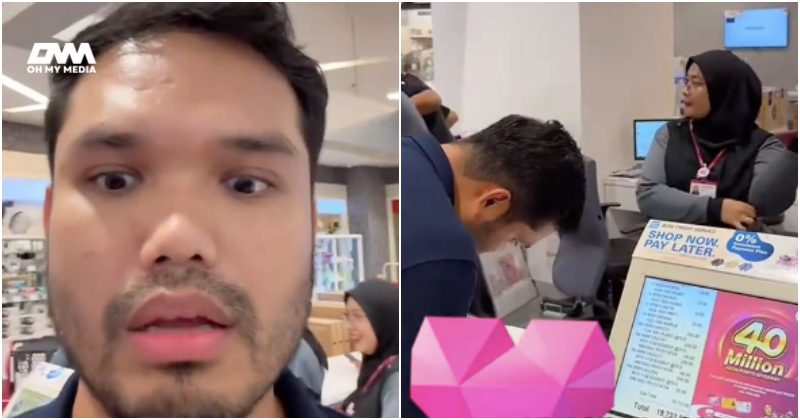

Lawyer responsible for loss of RM200,000 from own account, says bank

HSBC claims lawyer Manjeet Singh Dhillon had revealed vital information to a caller who claimed to be a representative of the bank.

KUALA LUMPUR: A bank facing a negligence suit filed by a senior lawyer following the withdrawal of RM200,000 from his account by an unknown party last year has denied liability for the transactions conducted.

HSBC Bank Malaysia Bhd said Manjeet Singh Dhillon had sole and exclusive use of online banking services provided to him.

“The services can only be accessed (using) the PIN and the security codes generated through the plaintiff’s (Manjeet) mobile phone, all of which are within (his) sole and exclusive knowledge and custody,” the bank said in its defence filed early last month.

HSBC said it was Manjeet’s responsibility to keep his personal identification number (PIN), the mobile device and a mobile security key (MSK) secure and under his personal control at all times.

“Therefore, it is the plaintiff who is fully responsible for any transaction,” it added.

The bank said Manjeet’s online banking service was accessed with his username and PIN together with a “log on code” generated from his MSK on Oct 14, last year.

It said the subsequent third-party fund transfers were effected via internet banking without the need to generate transaction verification codes.

HSBC also alleged that Manjeet had revealed vital information to a caller who claimed to be its representative.

It added that attempts to trace and recover the funds transferred out of Manjeet’s account were unsuccessful as the money was withdrawn immediately after the impugned transactions were effected.

HSBC said it had responded to a letter of demand issued by Manjeet dated Oct 17 last year.

It said any tortious duty allegedly owed by the bank to Manjeet cannot supersede and must be consistent with the terms and conditions of online banking.

Manjeet wants HSBC to pay him RM200,000 on grounds that the bank had allegedly facilitated its “fraudulent” withdrawal by its alleged negligence.

The former Malaysian Bar president is also seeking general damages for mental distress, hurt and anxiety suffered following the “fraudulent” transactions.

The lawyer, who filed the suit in the sessions court here on March 28, said he had opened an account with the bank on Jan 2, last year.

He said he deposited RM200,000 into this new account, the minimum needed to maintain the account.

On Oct 14, within a span of 20 minutes between 2.31pm and 2.51pm, HSBC had allowed 12 withdrawal transactions from the account, Manjeet claimed.

He said the bank only notified him of the withdrawals by way of text messages after all the transactions had taken place.

Manjeet said the bank did not get his consent for the transactions as it had not sent him a transaction authorisation code (TAC).

He said he neither had a relationship with nor knowledge of the recipient of the money who had withdrawn the amount.

Manjeet said the bank owed him a duty of care which it breached when transferring money out of his account.

Desain Rumah Kabin

Rumah Kabin Kontena

Harga Rumah Kabin

Kos Rumah Kontena

Rumah Kabin 2 Tingkat

Rumah Kabin Panas

Rumah Kabin Murah

Sewa Rumah Kabin

Heavy Duty Cabin

Light Duty Cabin

Source