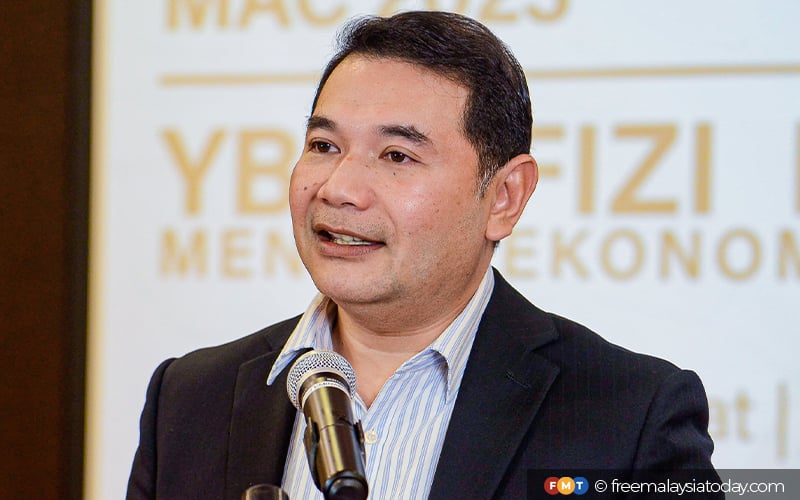

Ringgit impacted by exporters not repatriating earnings, says Rafizi

Some exporters do not immediately exchange their US dollar earnings for ringgit and repatriate it to Malaysia.

PUTRAJAYA: The ringgit has been in a freefall this year, and is one of the worst performing Asian currencies against the US dollar year-to-date. A reason for the local currency’s performance is the reluctance of some Malaysian exporters to repatriate their earnings to Malaysia, economy minister Rafizi Ramli said today.

He said exporting companies are paid in US dollars but there are exporters who do not immediately exchange it for ringgit and bring it back to Malaysia. He added this was a “normal thing”.

“When that amount is big and continues [to grow], it will affect the ringgit,” he told the media at May 2023 consumer price index briefing today.

Bank Negara Malaysia (BNM) announced yesterday that in an effort to stabilise the ringgit, it would intervene in the foreign exchange (forex) market to stem excessive currency movements.

The ringgit is the second worst performing Asian currency year-to-date, having fallen 5.94%. The Japanese yen, which has fallen 9.78%, ranks last.

Rafizi noted it is routine for BNM to monitor flows of money such as exports and foreign direct investment (FDI), and this is what the central bank meant when it said it would intervene in the forex market yesterday.

“In the context of BNM’s statement, when they say intervene, BNM is actually monitoring whether cash is being repatriated back to Malaysia.

“When the [value] of our currency is lower in the market, it gives the appearance there is no FDI in Malaysia (when in fact) FDI in the first quarter of this year is very high,” he added.

BNM’s announcement of possible intervention in the foreign exchange market seemed to have tempered the selling pace of the ringgit today.

However, SPI Asset Management MD Stephen Innes said this may not be permanent unless exporters begin to sell their US dollar holdings from export proceeds, which have grown to around US$26.5 billion (RM118.64 billion), or 15.3% of total banking deposits by businesses.

“Other than the US Federal Reserve sounding more dovish, I am not sure what can stem the weaker tide, especially with the yuan expected to weaken further over the short-term,” he told Bernama.

Year-low inflation

Meanwhile, remarking on the 2.8% inflation rate recorded in May, Rafizi said it is the lowest number recorded in a year, and he sees it continuing to fall going forward.

“When inflation reaches the 2% to 2.5% threshold, the price (of goods) rises very marginally and is almost the same as the price a year ago.

“When it hits 2.5% in August and September this year, it will help reduce cost of living,” he said.

The government cannot only look at the price of goods when evaluating the cost-of-living crisis. The government will also ensure that wages and income rise alongside inflation, he said.

Rafizi said the working paper for this progressive wage model (PWM) will be presented to the National Economic Action Council next month.

The PWM is simply a form of job-specific minimum wage where salaries rise regularly on a controlled pay-scale based on skills training, career development and strategies to increase productivity.

Desain Rumah Kabin

Rumah Kabin Kontena

Harga Rumah Kabin

Kos Rumah Kontena

Rumah Kabin 2 Tingkat

Rumah Kabin Panas

Rumah Kabin Murah

Sewa Rumah Kabin

Heavy Duty Cabin

Light Duty Cabin

Source