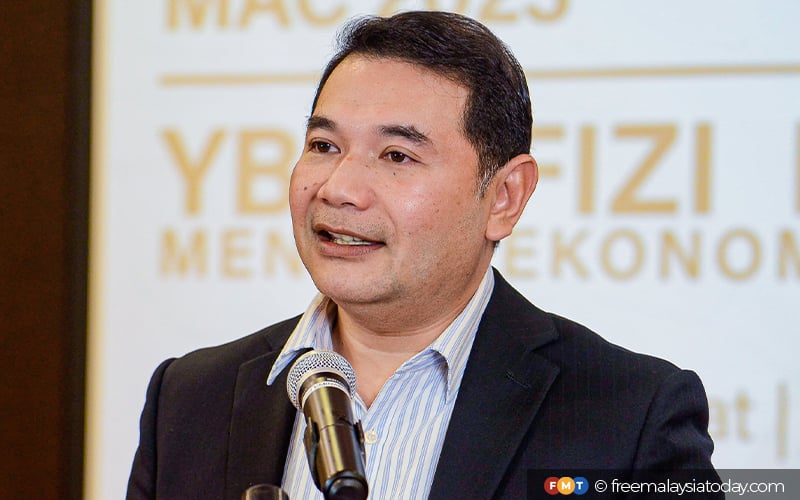

Unity government not in favour of GST system, says Rafizi

PUTRAJAYA: Economy minister Rafizi Ramli said the government favours non-regressive forms of tax revenues rather than the controversial goods and services tax (GST) when it comes to contributing to the government’s coffers.

Although the GST is the most efficient and transparent tax system, its reintroduction will further hurt poor households, he said.

“Besides it (GST) being the most efficient means of preventing tax evasion, its implementation calls for careful consideration to avoid taxing millions of households that are not in the taxable income bracket.

“Furthermore, we must also consider its impact on the country’s micro-economic sector prior to prioritising broadening of the tax base,” he said at the launch of the 17th World Chinese Entrepreneurs Convention.

As such, Rafizi said the government is not in favour of GST or any form of value-added tax system given its “regressive impact on the economy”.

Non-regressive tax revenues essentially mean reduced tax burden on consumers who can least afford to pay for commodities as well as leaving more money in the pockets of low-wage earners. As a result, they are likely to spend more of it on essential goods and stimulate the economy in the process.

The government will therefore resort to options such as indirect taxes, consumption taxes and non-regressive forms of tax revenues which have fewer refund complexities, and let consumers be in control of what they pay as tax, he added.

Rafizi also addressed speculation on the introduction of the capital gains tax (CGT) to be levied on the sale of assets, stocks and real estate. He said although the Cabinet agreed in principle on the implementation of CGT on unlisted shares, the time and means of its implementation resides with the finance ministry, which oversees fiscal policy and taxation.

During the tabling of the 12th Malaysia Plan mid-term review, Prime Minister Anwar Ibrahim, who is also the finance minister, said the CGT which is set to be introduced next year will not burden consumers.

Desain Rumah Kabin

Rumah Kabin Kontena

Harga Rumah Kabin

Kos Rumah Kontena

Rumah Kabin 2 Tingkat

Rumah Kabin Panas

Rumah Kabin Murah

Sewa Rumah Kabin

Heavy Duty Cabin

Light Duty Cabin

Source