How to Turn Your EPF into Your Dream Home in 3 Simple Steps 💰🏠 | RumahHQ

How to Turn Your EPF into Your Dream Home in 3 Simple Steps 💰🏠

Hey there, fellow Malaysians! So, you’re daydreaming about that perfect home – maybe a cozy bungalow in the suburbs or a chic apartment in the heart of the city? Well, guess what? Your dreams might be closer than you think, and it all starts with a little something called your EPF (Employees Provident Fund). Yes, those hard-earned savings can actually help you get the keys to your dream abode.

In this guide, we’re going to break down the process into three super simple steps that will have you mapping out your future home sweet home in no time! Whether you’re a first-time buyer or just thinking of making the leap, stick around as we put that EPF to work for you. Let’s dive in and turn those dreams into reality! 🏡✨

Unlocking the Potential of Your EPF for Homeownership

Are you ready to make your home-owning dreams come true? With your Employees Provident Fund (EPF), you have access to a fantastic resource that can help you step into your dream home sooner than you think. But it’s not just about having the funds; it’s about knowing how to utilize them effectively! You can tap into your EPF savings to cover down payments, monthly installments, and even renovation costs. Here are some key points to keep in mind:

- Understand the Eligibility: Check if you qualify for EPF withdrawals for housing purposes.

- Know the Limits: Familiarize yourself with the maximum withdrawal amounts.

- Plan Your Finances: Create a budget that aligns your EPF withdrawals with your overall financial plan.

Next up, it’s all about the strategy! When planning your withdrawals, consider making incremental withdrawals for different stages of your home purchase. This way, you can maintain a healthy EPF balance while easing the financial burden of moving into a new place. Plus, think about leveraging financing options from banks to further enhance your purchasing power:

| Type of Loan | Interest Rate | Tenure (Years) |

|---|---|---|

| Conventional Loan | 4.0% – 5.5% | 25 |

| Islamic Financing | 3.5% – 5.0% | 30 |

| Government Housing Loan | 3.0% - 4.5% | 30 |

Lastly, don’t forget to explore additional perks and assistance programs designed for first-time homebuyers! These can not only provide extra financial relief but can also guide you through the complexities of the home-buying process. Look out for special government schemes aimed at helping young Malaysians like you, ready to take that leap into homeownership. Your EPF can be a powerful ally on this journey, so invest your time in understanding all the options available to maximize your future!

Understanding the EPF: A Comprehensive Guide for First-Time Homebuyers

If you’re diving into the world of property ownership for the first time, knowing how to leverage your Employees Provident Fund (EPF) is crucial. This fund is more than just a retirement package; it can be your ticket to owning that cozy apartment or spacious home you’ve been dreaming about. With some savvy planning, you can turn a portion of your EPF savings into a down payment, making it easier than ever to step onto the property ladder.

Here’s how you can get started:

- Eligibility Check: First things first, find out if you qualify to withdraw from your EPF account. Generally, you can withdraw for the purchase of a house after 1 year of contributing to the EPF, and you must be a first-time buyer.

- Understand the Process: Get familiar with the steps involved in the withdrawal process. This includes completing the necessary forms, providing required documents like the Sale and Purchase Agreement, and submitting them to EPF.

- Financial Calculation: Crunch some numbers to see how much you can afford. EPF allows you to withdraw a percentage based on your contributions, so knowing your finances will help in deciding which property fits your budget.

This table summarizes the steps you need to take for a smooth EPF withdrawal:

| Step | Action |

|---|---|

| 1 | Check your EPF eligibility for housing withdrawal. |

| 2 | Gather necessary documents for the withdrawal. |

| 3 | Submit application to EPF with the required forms. |

Mapping Out Your Financial Landscape: Assessing Your EPF Balance

Before diving into your dream home plans, it’s crucial to take a good look at your EPF balance. This money can be a powerful tool in your home-buying journey, but you have to know exactly where you stand. Start by checking your EPF statement—this will give you a glimpse of your savings and contributions. Remember to consider:

- Current EPF Balance: This is your total savings available for withdrawal.

- Employer Contributions: Ensure you’re getting the maximum contributions from your employer, which can significantly boost your savings.

- Future Contributions: Think about how much you’ll continue to save in the coming months.

Your EPF savings can be used for multiple home-buying purposes, from down payment to renovation costs. It’s not all about the money now, but also how much you can grow your EPF through wise investments or even EPF investment schemes. Look into:

- Withdrawal Options: Familiarize yourself with the types of withdrawals for purchasing a home.

- Investment Opportunities: Assess if you want to leave your EPF funds as is or invest them for better returns.

- Usage Categories: Know what you can utilize the funds for, such as buying property or settling a housing loan.

take a moment to project your future financial landscape. It’s not just about the here and now; rather, you should envision how your EPF can work for you long-term. Think of factors like:

| Factor | Consideration |

|---|---|

| Market Trends | How the property market reacts in the coming years. |

| Interest Rates | Possible changes and how they affect your mortgage plan. |

| Living Costs | Anticipated monthly expenses tied to home ownership. |

With a solid understanding of your EPF balance, you’ll be empowered to make informed decisions as you work towards your dream home. Remember, planning ahead is key to turning your financial landscape into a reality!

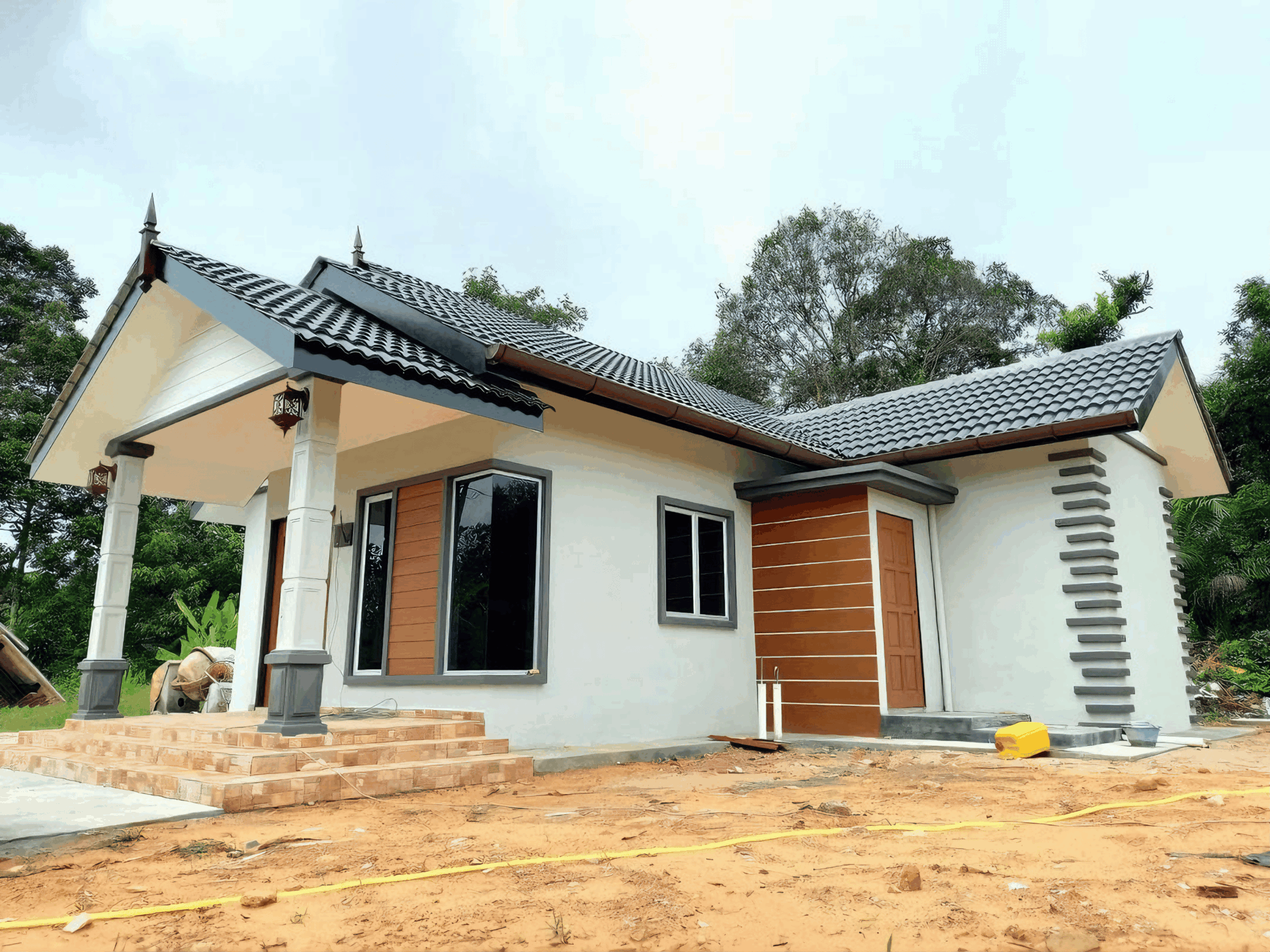

Setting the Stage: Choosing the Right Property That Fits Your Budget

Choosing the right property is like finding a perfect puzzle piece that fits just right into your aspirations while respecting your financial comfort. Before diving headfirst into property hunting, it’s vital to set a clear budget. Determine how much of your EPF savings you’re willing to allocate towards the purchase without sacrificing your other financial commitments. This gives you the freedom to explore without fear of overspending.

Next, consider what type of property aligns with your lifestyle. Here are a few options to keep in mind:

- Condos: Great for those who love urban living and amenities.

- Terraced Houses: Perfect for families seeking space.

- Apartments: Ideal for individual buyers looking for budget-friendly options.

- Land: For those who dream of building their own home one day.

don’t forget to factor in ongoing costs such as maintenance fees, property taxes, and insurance. Here’s a quick table to help you visualize these potential extra costs:

| Cost Type | Estimated Monthly Amount |

|---|---|

| Maintenance Fees | RM 250 |

| Property Tax | RM 150 |

| Insurance | RM 100 |

Building a realistic picture of both your limitations and needs will set you on the right path. So, take your time, do your research, and pick a property that not only dazzles your heart but also aligns with your budget!

Maximizing EPF Withdrawals: Navigating the Rules and Regulations

“`html

When it comes to using your EPF (Employees Provident Fund) for your dream home, understanding the rules and regulations is key to maximizing your withdrawals. First off, make sure you meet the eligibility criteria. Not just anyone can dip into their EPF savings; you need to be either a first-time home buyer or looking to settle in a property that’s your primary residence. So, double-check your status before you leap into any financial commitments. If you’re eligible, you can withdraw from both Account 1 and Account 2, but keep track of how much you’re taking out.

Next up, familiarize yourself with the various withdrawal methods available. There are a few options, including full withdrawal for buying a new home or partial withdrawal for settling monthly mortgage payments. Keep in mind that there are different forms to fill out and specific procedures to follow for each option. To make things easier, gather all necessary documentation beforehand. This includes proof of income, property documents, and EPF statements. The smoother your preparation, the faster the process will be!

don’t forget to factor in the sustainability of your financial plan. After you’ve successfully made your withdrawal, consider how it fits into your long-term goals. Having your dream home is fantastic, but ensure you can manage your post-purchase expenses too. Build a financial buffer for things like home maintenance, council taxes, and unexpected bills. Remember, a well-planned financial strategy will not only help you secure your home but also maintain it without stress.

“`

Smart Financing Options: Blending EPF with Home Loans

Making Your Dream Home a Reality: Effective Planning and Execution

When thinking about converting your Employee Provident Fund (EPF) into your dream home, the first step is setting clear goals. Start by envisioning the type of home you want. Is it a cozy apartment, a single-storey house, or a modern condo? Make a list of your priorities – things like number of bedrooms, proximity to work or school, and your budget. When you know what you want, it becomes easier to strategize on how to get there. Consider factors such as location and amenities that matter to you, as these will play a significant role in your decision-making process.

Next comes the planning phase. Create a detailed financial plan that includes not just the purchase price of the home, but also other costs like renovation, maintenance, and property taxes. It’s wise to consult with professionals like real estate agents or financial advisors who understand the Malaysian property market. Additionally, consider your financing options – using EPF savings could significantly reduce your mortgage. Below are a few key items to include in your plan:

- Expected down payment percentage

- Monthly budget for housing

- Future financial commitments

- Potential growth in property value

Lastly, it’s time for action and execution. With a clear plan in hand, start browsing properties that meet your criteria. Attend open houses and don’t hesitate to ask questions; knowledge is power! Make use of technology, like property apps, to streamline your search. And once you find “the one”, be prepared to negotiate – every ringgit counts! Below is a simple table to compare property options:

| Property Type | Location | Price (MYR) | Bedrooms |

|---|---|---|---|

| Apartment | Kuala Lumpur | 450,000 | 2 |

| Terrace House | Petaling Jaya | 750,000 | 3 |

| Condo | Subang Jaya | 550,000 | 2 |

Post-Purchase Considerations: Managing Your New Investment Wisely

Congratulations on your new home! Now that you’ve turned your EPF savings into a cozy nest, it’s time to ensure that this investment flourishes. The key to managing your property wisely lies in regular maintenance and wise budgeting. Set aside a portion of your monthly income for home upkeep—things like plumbing repairs, roof maintenance, and even garden care can add up quickly if neglected. Here’s a quick list of essential maintenance tasks to keep in mind:

- Inspect regularly: Check for leaks, cracks, or mold.

- Service appliances: Regularly maintain your air conditioning and heating systems.

- Landscaping: Dedicate time to the outdoor areas to preserve curb appeal.

Furthermore, keeping an eye on property value is crucial. Keep an updated checklist for renovations or upgrades that could enhance your home’s marketability in the future. Here’s a simple table to help you plan your improvements:

| Renovation Type | Potential Increase in Value (%) | Estimated Cost (RM) |

|---|---|---|

| Kitchen Remodel | 10-15% | 20,000 – 50,000 |

| Bathroom Update | 5-10% | 10,000 – 25,000 |

| Outdoor Decking | 5-8% | 5,000 – 15,000 |

don’t forget about some softer aspects of property ownership, like insurance and community involvement. Balancing your financial commitment with both good insurance coverage and a positive relationship with your neighbors can enhance your living experience. Join local community groups or engage in neighborhood events. It’s a fantastic way to create a supportive environment, increase home security, and might even lead to friendships that could help in times of need!

To Wrap It Up

So there you have it, folks! Turning your EPF into your dream home doesn’t have to be rocket science. With these three simple steps, you can move from daydreaming about that perfect space to actually walking through its front door. Whether you’re eyeing a cozy apartment or a spacious landed property, the EPF should be your trusty sidekick in this journey.

Remember, every great home starts with a solid plan, so take your time, do your homework, and make sure you’re choosing what’s best for you and your family. It might feel like a big leap, but with a little bit of patience and smart decisions, you’ll be well on your way to unlocking that dream home!

Now, go ahead and take that first step—you’ve got this! Happy house hunting! 🏡💪